It has been everywhere the last few days, but let me break this down in a way that’s easy to understand for everyone.

The newly approved federal Republican tax-cut bill limits the SALT deduction (state and local taxes to include property tax and income tax) to $10,000.

This can potentially crush people who live in high income high tax states, like MD (granted the brackets are a little different).

Because of that, MoCo passed a bill to allow prepayment of property taxes (for tax year 2017) to get the deduction this year, since the new law goes into effect in 2018. The payment must be received in person or postmarked by January 1st.

Some people think the IRS may not allow this since the 2018 property tax assessment letters aren’t mailed out until July, but it’s worth a shot in case the county attorney can find a loophole to save some money this year since there currently no SALT limit.

Here is more information, from the county, on how and when to prepay your property tax if you choose to:

http://www.montgomerycountymd.gov/finance/Resources/Files/2018_prepay/Property_Tax_Prepayment_Info_V2.pdf

UPDATE FROM THURSDAY EVENING (12/28/17): http://www2.montgomerycountymd.gov/mcgportalapps/Press_Detail.aspx?Item_ID=21701

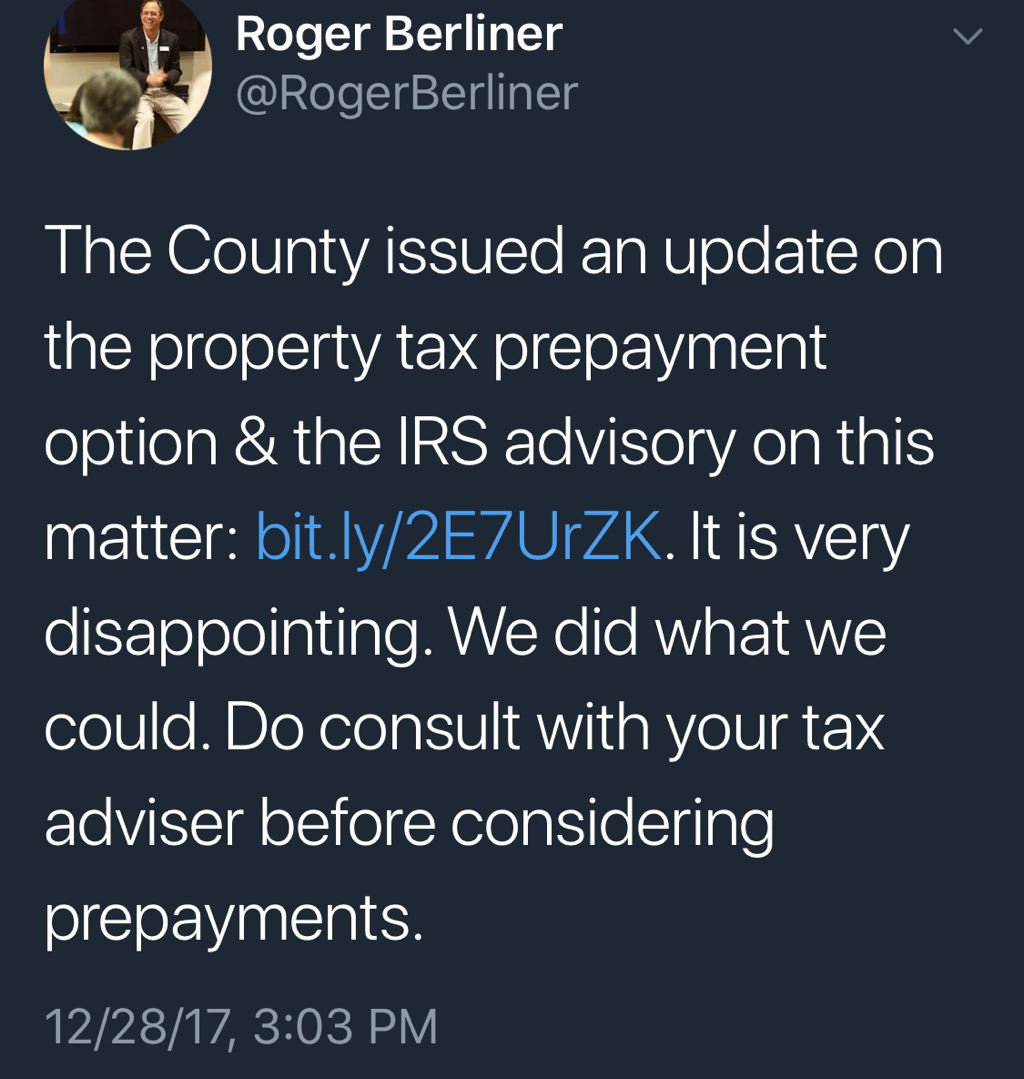

Comment from Roger Berliner below:

Recent Stories

Mayor Jud Ashman and members of the City Council hosted the 2024 State of the City address on Thursday, April 18, at Asbury Methodist Village.

FEST OF SPRING Caribbean Wine Food & Music Festival

Get ready to experience the vibrant colors, tantalizing flavors, and infectious rhythms of the Caribbean at the FEST OF SPRING Caribbean Wine Food & Music Festival! Hosted by RHU LLC, this exciting festival is set to take place on May 18, 2024, at the picturesque 16700 Barnesville Rd in Boyds, MD.

Step into a world where the Caribbean spirit comes alive! From 12:00 PM onwards, immerse yourself in a sensory journey that celebrates the unique culture, cuisine, and music of the Caribbean. Whether you're an African American, a Reggae or Soca music enthusiast, a wine lover, or part of the vibrant Caribbean diaspora, this festival promises to delight and captivate you in every way.

Let the enticing aromas of mouthwatering Caribbean dishes tantalize your taste buds. Feast on traditional delicacies prepared by expert chefs, showcasing the rich and diverse culinary heritage of the Caribbean. Indulge in flavorful jerk chicken, succulent seafood, and delectable plantain dishes that will transport you straight to the islands.

Accompanying the culinary extravaganza is a carefully curated selection of premium wines, ensuring the perfect pairing for your palate. Sip on fine wines from renowned vineyards, each sip a reflection of the Caribbean's vibrant spirit. Discover new flavors, expand your wine knowledge, and savor unforgettable moments with every glass.

As the sun sets, get ready to groove to the infectious rhythms of Caribbean music. Feel the pulsating beats of reggae, soca, dancehall, and calypso, moving your body to the lively melodies. Live performances by talented musicians and performers will keep the energy high, ensuring a night of unforgettable entertainment.

Don't miss this opportunity to embrace the Caribbean spirit and celebrate the arrival of spring in style! Tickets are available on AllEvents, so secure your spot today. Join us at the FEST OF SPRING Caribbean Wine Food & Music Festival, where cultures collide and unforgettable memories are made.

LIVE PERFORMANCES By: CULTURE Feat. Kenyatta Hill, EXCO LEVI, IMAGE BAND, RAS LIDJ REGG'GO with Special Guest SUGAR BEAR FROM E.U. & MORE! & MORE!

MUSIC By: DJ ABLAZE, DJ SMALLY & NAJ SUPREME

2 NIGHT Camping packages available: RV/CAMPER $200 | TENTS $150 Starting on Friday May 17 @ 5pm | 30 RV SPACES | 30+ TENT SPACES

KIDS 12 & UNDER FREE!!!